Milena has a gross biweekly income – Milena’s gross biweekly income is a crucial aspect of her financial well-being. Understanding the components, calculation, and implications of her gross biweekly income is essential for effective budgeting, tax planning, and long-term financial success.

This guide delves into the intricacies of Milena’s gross biweekly income, providing a comprehensive overview of its definition, calculation, budgeting, tax implications, savings strategies, and retirement planning considerations.

1. Milena’s Gross Biweekly Income: Milena Has A Gross Biweekly Income

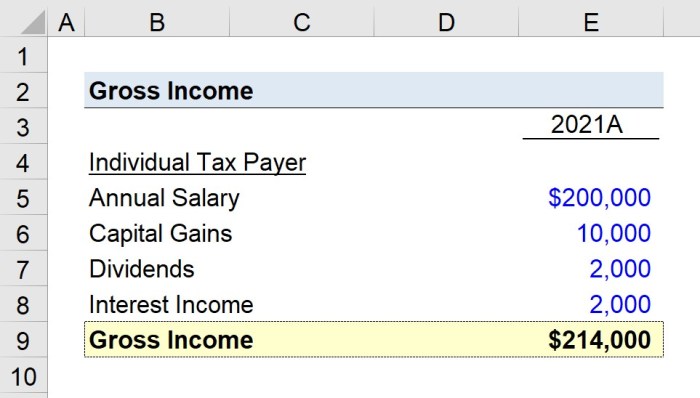

Gross biweekly income refers to the total amount of earnings received by an individual over a two-week period before any deductions or taxes are withheld.

Components of Gross Biweekly Income

- Wages

- Bonuses

- Commissions

- Overtime pay

- Other forms of compensation

Factors Affecting Gross Biweekly Income

- Hourly wage or salary

- Number of hours worked

- Overtime hours

- Deductions for benefits (e.g., health insurance, retirement contributions)

- Tax withholdings

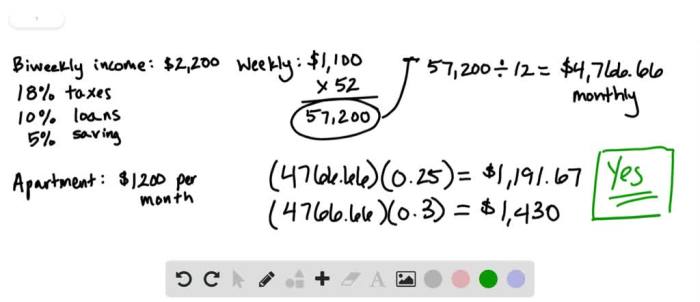

2. Calculating Gross Biweekly Income

Steps Involved

- Determine your hourly wage or salary.

- Multiply your hourly wage by the number of hours worked in a week.

- Multiply the result by the number of weeks in a pay period (typically two).

- Add any additional compensation (e.g., bonuses, commissions).

Example

If Milena earns $15 per hour and works 40 hours per week, her gross biweekly income would be calculated as follows:

$15/hour x 40 hours/week x 2 weeks = $1,200

Adjustments

If Milena has any deductions or tax withholdings, these would be subtracted from her gross biweekly income to arrive at her net biweekly income.

3. Budgeting with a Gross Biweekly Income

Budgeting is crucial for managing a gross biweekly income effectively. It allows individuals to track their income and expenses, ensuring that they are meeting their financial obligations and saving for the future.

Tips for Creating a Budget

- Track all income and expenses.

- Categorize expenses (e.g., housing, food, transportation).

- Set financial goals (e.g., saving for a down payment, retirement).

- Allocate funds to different categories based on priorities and financial goals.

- Review and adjust the budget regularly.

4. Taxes and Gross Biweekly Income

Taxes are deducted from gross biweekly income to fund government programs and services. The amount of taxes withheld depends on various factors, including:

Types of Taxes Withheld

- Federal income tax

- State income tax

- Social Security

- Medicare

Estimating Tax Withholdings

Individuals can use tax withholding calculators or consult with a tax professional to estimate the amount of taxes that will be withheld from their gross biweekly income.

5. Savings and Gross Biweekly Income

Saving money is essential for financial security and achieving long-term financial goals. Individuals with a gross biweekly income should prioritize saving a portion of their earnings.

Tips for Saving Money

- Set financial goals and create a savings plan.

- Automate savings by setting up automatic transfers from a checking account to a savings account.

- Reduce unnecessary expenses.

- Consider additional income streams (e.g., part-time job, side hustle).

6. Retirement Planning with a Gross Biweekly Income

Retirement planning is crucial for individuals with a gross biweekly income to ensure financial security in their later years. Retirement accounts offer tax advantages and allow individuals to save for the future.

Types of Retirement Accounts

- 401(k) plans

- IRAs (Individual Retirement Accounts)

- Annuities

Contributing to a Retirement Account, Milena has a gross biweekly income

Individuals can contribute a portion of their gross biweekly income to a retirement account, reducing their current taxable income and potentially increasing their retirement savings.

Common Queries

What is gross biweekly income?

Gross biweekly income refers to the total amount of earnings an individual receives before any deductions or taxes are withheld.

How is gross biweekly income calculated?

Gross biweekly income is typically calculated by multiplying the hourly wage by the number of hours worked during a two-week pay period.

What factors can affect gross biweekly income?

Factors that can affect gross biweekly income include overtime, bonuses, commissions, and deductions for benefits or taxes.

Why is budgeting with a gross biweekly income important?

Budgeting with a gross biweekly income allows individuals to allocate their earnings effectively, ensuring that essential expenses are covered and financial goals are met.